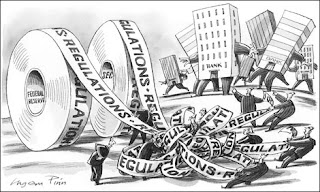

Obama Administration's Regulation Strangulation Wreaks Havoc

One would think the rising demand for trucking which has driven industry revenues up to $700 billion last year, would be a boon for fleet owners like Jim Burg of Warren Michigan. Thanks to crippling federal regulations, that is not the case. New regulations on emissions, and rules that limit driver hours on the road have driven up cost for truckers. Hundreds of smaller trucking outfits with fewer than fifteen vehicles have gone out of business as they struggle to adapt to the higher cost. Others have been acquired by larger operators who have the deeper pockets to deal with the increasing expenses."I haven't grown in three years," said Burg. " I don't know what my cost are going to be in two years.

Many trucking outfits are struggling to attract enough new drivers as cost increase, forcing many to pay signing bonuses. If that isn't enough, soon the Federal Motor Carrier Safety Administration will require all trucks to be equipped with electronic devices that will track the number of hours that trucks are on the road. These so called "e-logs" set mandatory breaks between shifts. Some truckers complain that this structure does not take into account important factors such as location, rest stop parking, traffic flow and natural sleep patters. According to industry analyst Donald Broughton of Avondale Partners, LLC "A lot of these guys will go out of business". Some smaller independent truckers are threatening to leave the industry or retire once e-logs become mandatory. Several other industries are also feeling the effects of the Fed's constricting regulatory tentacles. The banking, and energy industries have been squeezed on several fronts. New restrictions on energy lending may force banks to curtail lending to oil producers. The government has expressed concerns that so called reserve loans which are loans against oil and gas assets have become to risky in light of lower oil prices.

Wait, there's more. Federal programs meant to make college loans more affordable and ease the debt burden on borrowers may backfire. The program allows borrowers to scale back their repayments. The timing could not be worse. Students loan defaults are already on the increase and this will further dampen bank revenues and may force them to cut back on future lending as investors lose their appetite for student debt. The administration cut a D.C. voucher program vital to African American children. Also several historically black colleges and universities lined up to sue Obama's education department for changes it made to the student loan plus program. Changes they claim disqualified thousands of black students from receiving student loans.

Want more? The Affordable Health Care act, also known as Obamacare is unraveling. Large health insurers like Aetna and United health are dropping out. Premiums are rising and taxes have been levied in retiree health plans.

There is a never ending battle to make our politicians understand that every intervention in the economy brings unintended consequences. I guess this is what change looks like. In life and politics, sometimes less is more.

Comments